In general term stamp duty will be imposed to legal commercial and financial instruments. Stamp duty of a lease agreement.

Tenancy Agreement In Malaysia Complete Guide And Sample Download

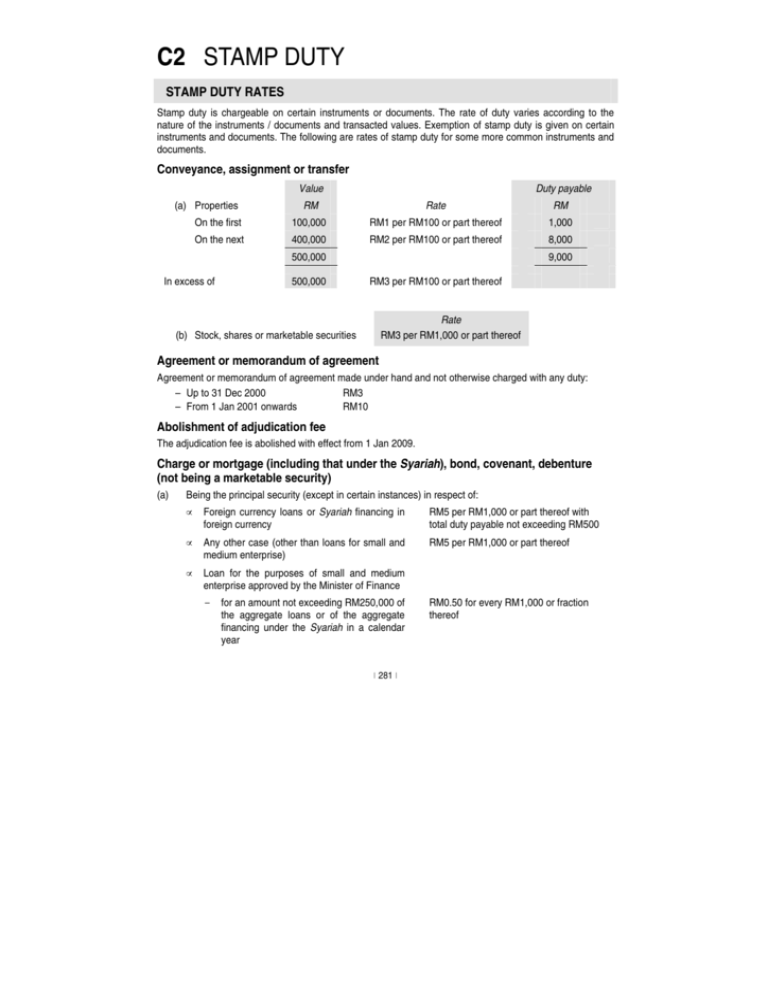

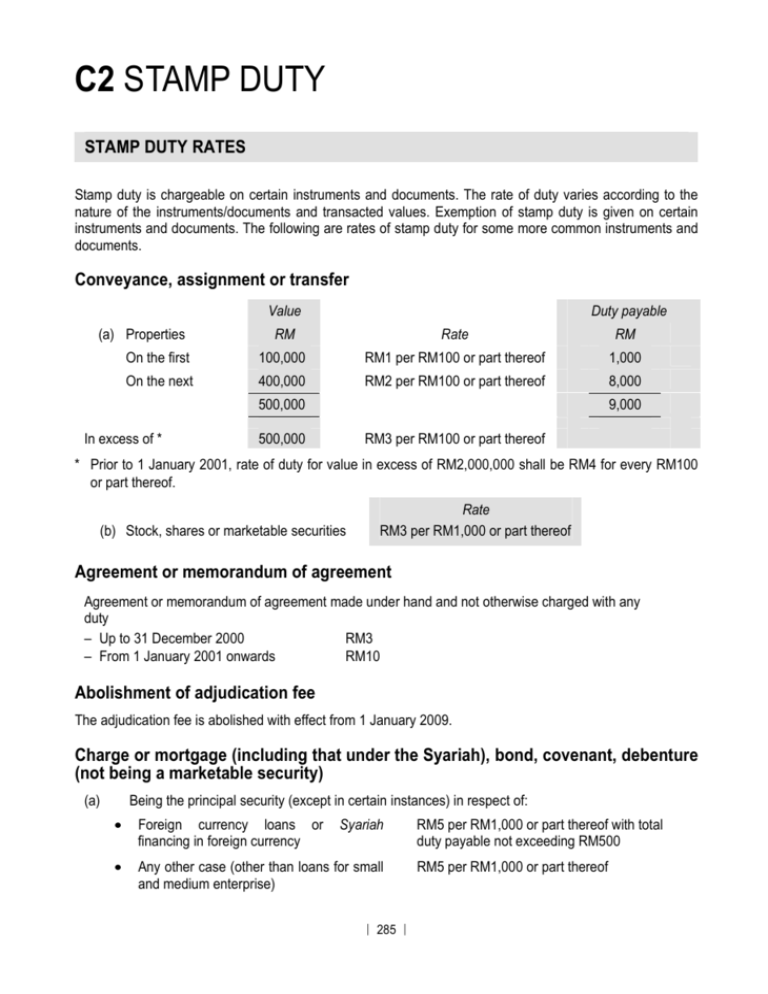

In Malaysia Stamp duty is a tax levied on a variety of written instruments specifies in the First Schedule of Stamp Duty Act 1949.

. The reason why agreements need to be stamped is stated under section 521a where. The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949. RM5000 or 10 of the amount of the deficient duty whichever sum be the greater if the instrument is stamped later than 3 months but not later than 6 months after the time for stamping.

However the duty was reduced to 0. The stamp duty rate is prescribed under the Stamp Act 1949. Instruments exported to Malaysia and subject to customs duties must be stamped within 30 days of the execution date.

The stamp duty is free if the annual rental is below RM2400. RM2500 or 5 of the amount of the deficient duty whichever sum be the greater if the instrument is stamped within 3 months after the time for stamping. Based on the table below this means that for tenancy periods less than 1 year the stamp duty fee is RM1 per RM250.

The Haryana State Government has decided to cut stamp duty on loan agreements to just 100. Contractor and the sub-contractors. And if the Tenancy Agreement has been signed for more than 3 years the.

But for those who rent whether youre the landlord or the tenant youll likely find that theres a green chop in the deal. The buyer was liable for 5 stamp duty. Stamp duty for contracts at the third and subsequent levels will be fixed at RM5000 and any stamp duty paid in excess will be remitted.

Streamlined Document Workflows for Any Industry. The instrument of service agreement is to be executed by. As per a report in July 2020 the Tamil Nadu Government is likely to.

If your tenancy period is between 1 - 3 years the stamp duty fee is RM2 per RM250. There are two types of Stamp Duty namely ad valorem duty and fixed duty. The exemption applies for a maximum loan amount of RM500000.

Stamp duty is a duty imposed on document instrument listed under the First Schedule of Stamp Act 1949 which has legal commercial or financial implication THE IMPORTANCE OF STAMPING Document instrument must be duly stamped in order to be admitted ADJUDICATION OF DOCUMENT INSTRUMENT Application for adjudication must be made to the LHDNM Stamp. There is a RM1 Stamp Duty charge for each RM250 of annual rent over RM2400. The monthly rent for a 1-year tenancy is RM1800 that makes the annual rent RM21600.

Basically the Stamp Duty for Tenancy Agreements spanning less than one year is RM1 for every RM250 of the annual rent in excess of RM2400. If the RM loan agreement or RM loan instrument. The stamp duty is free if the annual rental is below RM2400.

RM1 for every RM1000 or any fraction thereof based on. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. This could be as cheap as RM10 but depending on your monthly rent you could pay close to RM1000.

For the saleassignment if no individual security is issued on the basis of the value set by the Stamp Office. First RM100000 x 1 Next RM400000 x 2 05 of loan amount RM450000 RM1000 RM8000 05 x RM450000 RM9000 RM2250. It has to be stamped at LHDN Lembaga Hasil Dalam Negeri Inland Revenue Board and there will be a stamping fee determined by LHDN stated under section 4 of the Stamp Act 1949.

The first RM2400 is then exempted from stamp duty RM21600 RM2400 RM19200. The stamp duty for a tenancy agreement in Malaysia is calculated as the following. The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949.

Tenancy agreement between 1 to 3 years RM2 for every RM250 of the annual rent above RM2400. For the ad valorem duty the amount payable will vary depending on type. The answer might surprise you even if a signed contract is not stamped it is actually VALID under the law.

The loan agreement Stamp Duty is 050 from the loan amount. Before the ruling came into effect on Jan 1 2009 contractors only needed to pay a flat stamp duty of RM10 per contract. It has to be based on the amount of monthly rental and the lease period-RM4 for every RM250 of the annual rental above RM2400.

Ii For contracts awarded by any party other than the Government stamp duty at Ad valorem rate will be levied on the contract between such party and principal contractor. 6 rows Shares or stock listed on Bursa Malaysia. Stamp duty of 05 on the value of servicesloans.

How Much Is The Tenancy Agreement In Malaysia. The exchange operator said MoF recently announced that the stamp duty is set at RM150 for every RM1000 or fractional part of RM1000 of the value of the contract note of any shares or stock and. Stamp duty on all instruments of an asset lease agreement transactions between a client and a financier between a client and a financier carried out in accordance with Syariahs principles for the rescheduling or.

Ringgit Malaysia loan contracts are generally taxed with a stamp duty of 05. A Ringgit Malaysia loan agreement generally attracts a 05 stamp duty. Stamp duty for instrument of transfer Stamp duty on loan agreement Total stamp duty to be paid.

Find Forms for Your Industry in Minutes. Ad State-specific Legal Forms Form Packages for Other Services. Below is the stamping fee calculation.

For contracts that are signed for anywhere between 1 to 3 years the stamp duty rate is RM2 for every RM250 of the annual rent in excess of RM2400. This agreement here the contractinstrument of dealing is what needs to be stamped. The Order provides that instruments of service agreements Note that are chargeable under Item 221a First Schedule of the SA will be subject to stamp duty at a rate of 01 ie the stamp duty chargeable in excess of 01 is remitted.

The stamp duty would then be charged according to the tenancy duration. The rationale for imposing the ad valorem rate of charge of 01 on a sub-service agreement under Paragraph 22b of the 2010 Order is that a service agreement relating to an undertaking awarded by a Ruler of a State or the Government of Malaysia or of any State or local authority is exempted from stamp duty. And this order came into effect on 1 Jan 2015 and are.

The reduced stamp duty shall apply to all loan agreements executed by such borrowers in favour of banks financial institutions and financial development corporations among others. How is stamp duty calculated. The stamp duty is free if.

Rather than a single fixed fee stamp duty for tenancy agreements are calculated based on every RM250 of the annual rental. If the loan amount is RM400000 the loan agreement stamp duty is RM400000 x 050 RM2000. 1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400.

Stamp Duty on Contract Agreement Lhdn. However for the following instruments stamp duty can be paid over 01. Stamp Duty Remission Order 2014 provides for the remission of 50 from the stamp duty chargeable on any loan agreement to finance the purchase of only one unit of residential property costing not more than RM500000 subject to the stipulated conditions.

If the loan amount is RM500000 the stamp duty for the loan agreement is RM500000 x 050 RM2500. Members of the Master Builders Association of Malaysia MBAM and its affiliates want the government to address the impact of the 05 ad valorem stamp duty imposed by the government on construction contracts.

Sale And Purchase Agreement In Malaysia 4 Important Clauses To Note

C2 Stamp Duty Malaysian Institute Of Accountants

Tenancy Agreement In Malaysia The Ultimate Guide Speedhome Guide

Do I Have A Contract Preliminary Agreements Acquisitions

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

Drafting And Stamping Tenancy Agreement

The Validity Of Unstamped Agreements In Malaysia Fareez Shah And Partners

C2 Stamp Duty The Malaysian Institute Of Certified Public

Stamping A Contract Is An Unstamped Contract Valid

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Stamp Duty Attestation And Registration Of Lease And Agreements Ipleaders

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Stamp Duty And Contracts Yee Partners

Rental Agreement Stamp Duty Malaysia Speedhome

Amended Tenancy Agreement 2013

Sale And Purchase Agreement Land And Building Ministry Of

Tenancy Agreement In Malaysia Complete Guide And Sample Download

How Much Does It Cost For Stamp Duty For Tenancy Agreement In Malaysia Ec Realty

Here Are 8 Important Clauses In A Sale And Purchase Agreement Spa